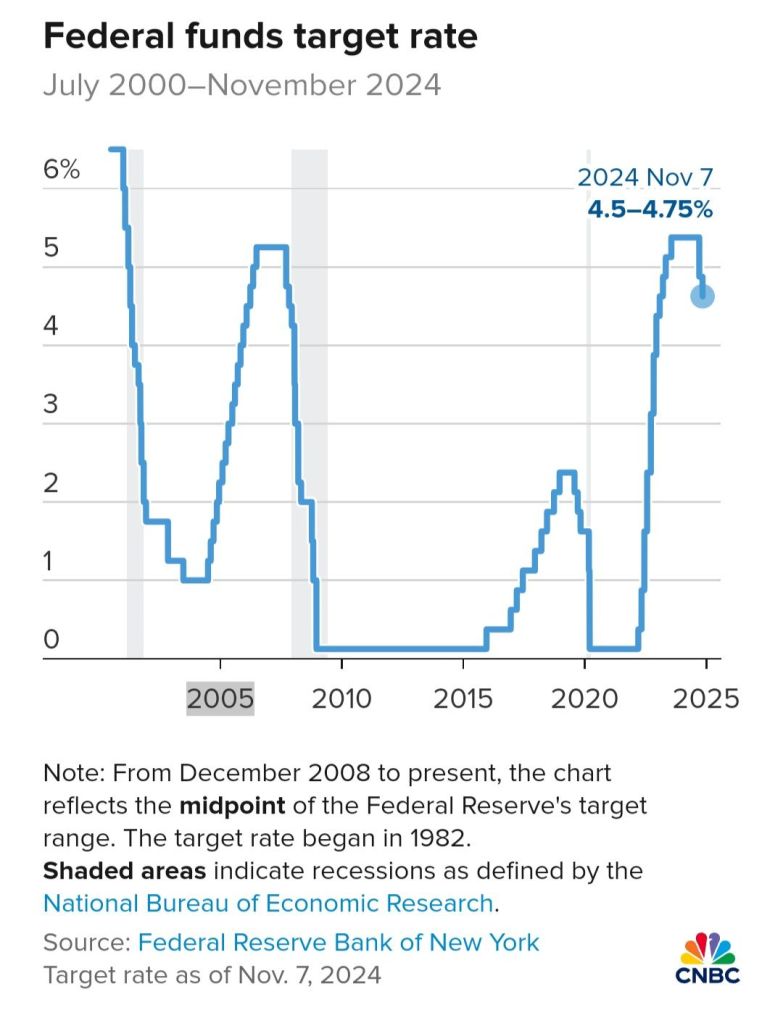

The Federal Reserve just hit the brakes on interest rate hikes for the second time in a row. This time, it’s a quarter-point decrease, bringing the benchmark borrowing rate to a target range of 4.50%-4.75%.

So, what does this mean for you?

Well, this rate influences everything from mortgages and credit cards to auto loans. While this move was widely anticipated, the big question is: will it be enough to steer the economy towards a “soft landing”?

Inflation vs. Employment: A Balancing Act

The Fed is walking a tightrope. They’re trying to tame inflation without triggering a recession. And it seems like they’re prioritizing job security just as much as fighting rising prices.

The Market’s Reaction? A Bit of a Head-Scratcher

Interestingly, despite the Fed’s rate cuts, mortgage rates and Treasury yields have actually gone up since September. It seems like the market has a mind of its own!

What’s Next?

Experts predict another quarter-point cut in December, followed by a pause in January. The Fed will then take a breather to assess the impact of its moves.

Key Takeaways:

- The Fed is taking a less aggressive approach to interest rate cuts.

- The focus is on balancing inflation control with a healthy job market.

- The market’s reaction to the rate cuts has been unexpected.

- More cuts are expected in the near future, but the Fed is proceeding with caution.

Want to learn more about how the Fed’s decisions impact your wallet? Stay tuned for updates!